Looking to take control of your finances? Wondering why you need a BUDGET? Well, you’re in the right place! In this blog post, we’re diving deep into the world of intentional financial management, exploring the perks of having a budget, sharing practical tips, and uncovering the transformative power of cultivating financial discipline. Whether you’re a budgeting pro or just starting, this guide is your key to stability, peace of mind, and financial freedom. Join us on a journey that’s all about you and those magical words: “you need a budget.” Let’s dive in!

Table of Contents

The Benefits of Having a Budget:

Budgeting is your ticket to financial stability, stress reduction, and a secure future. Here’s why you need a budget and the perks it brings:

Financial Stability:

A budget provides clarity on income and expenses, steering you away from financial instability and helping you build a safety net for unexpected costs.

* Here’s a free Google Sheet Budget Tracker

Peace of Mind:

Knowing where your money goes reduces financial stress. A well-crafted budget brings peace as your financial goals materialize and emergencies become manageable.

In short, budgeting is your proactive step toward stability, peace of mind, and a secure financial future.

Building a Solid Financial Foundation:

Your financial success starts with a robust foundation, and that foundation is built through budgeting. Here’s why you need a budget to serve as the bedrock for your financial well-being.

Cornerstone Role of a Budget:

Your budget acts as a blueprint, guiding your financial decisions and ensuring each choice contributes to building a strong foundation.

Achieving Short-Term and Long-Term Financial Goals:

Budgets are not just about day-to-day expenses; they are tools for realizing both short-term and long-term financial goals. Whether it’s a vacation, a home, or retirement, a well-crafted budget makes your financial goals achievable milestones.

You need a budget is not just a suggestion; it’s your blueprint for financial success. By embracing budgeting, you’re laying the groundwork for a secure financial future.

Practical Tips for Successful Budgeting:

Here are practical budgeting tips and how to make your budgeting efforts successful!

Actionable Tips for Budget Creation and Maintenance:

- Start with Clear Goals: Define your financial goals, whether it’s paying off debt, saving for a vacation, or building an emergency fund. Clear goals will guide your budgeting decisions.

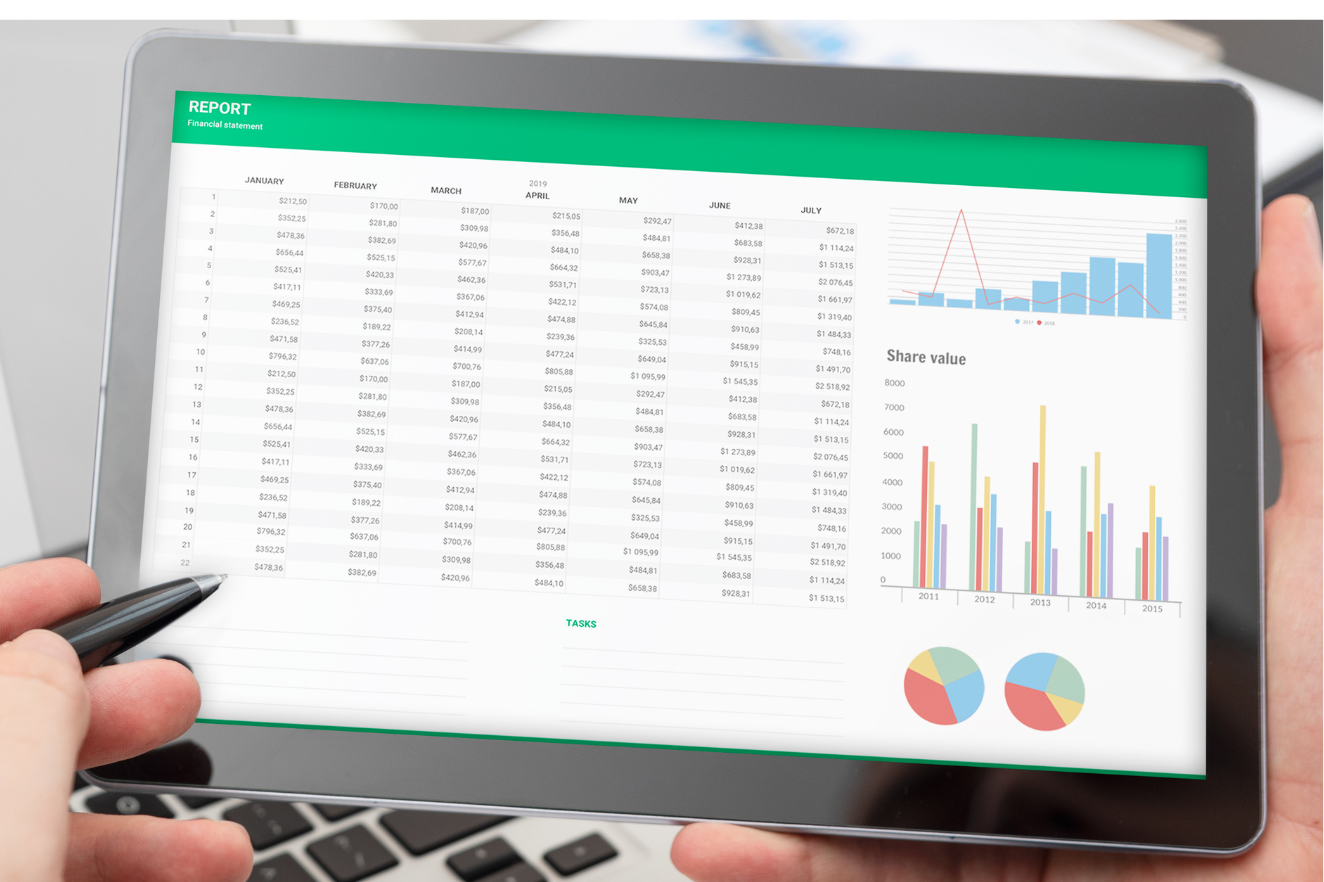

- Track Your Spending: Monitor every expense, big or small. Tools like apps or budgeting spreadsheets can simplify this process, making it easier to categorize and analyze your spending patterns.

- Create Realistic Categories: Break down your budget into practical categories like groceries, utilities, and entertainment. Realistic categories make it easier to allocate funds and track expenditures accurately.

Introduction to Budgeting Tools and Resources:

- Utilize Budgeting Apps: Explore user-friendly budgeting apps to streamline the budgeting process. These apps often offer features like expense tracking, goal setting, and financial insights.

- Educational Resources: Expand your budgeting knowledge through online tutorials, blogs, and financial literacy courses. Understanding the principles of budgeting enhances your ability to make informed financial decisions.

Guidance on Setting Realistic Budgeting Goals:

- Prioritize Essentials: Allocate a significant portion of your budget to essential expenses like housing, utilities, and groceries. This ensures that your basic needs are met before addressing discretionary spending.

- Emergency Fund Priority: Make building an emergency fund a top priority. Having a financial safety net provides peace of mind and safeguards your budget against unexpected expenses.

Addressing Common Budgeting Challenges:

In this section, we’ll explore practical strategies to overcome prevalent budgeting hurdles.

Identifying Challenges in Budgeting:

Before addressing solutions, let’s acknowledge two common challenges:

- Irregular Income: Managing finances becomes complex with irregular income. The unpredictability of paychecks can pose difficulties in establishing a consistent budget.

- Unexpected Expenses: Life’s uncertainties, such as unexpected car repairs or medical bills, can disrupt even the most carefully crafted budgets.

Practical Solutions and Strategies:

Now, let’s delve into practical solutions to navigate these challenges effectively.

- Flexible Budgeting: Tailor your budget to accommodate irregular income. Design it based on the minimum expected income and adjust spending when additional funds become available. This approach ensures financial stability despite fluctuations.

- Emergency Fund: Establishing and regularly replenishing an emergency fund acts as a financial safety net. This fund enables you to address unforeseen expenses without derailing your budget.

Adaptability of Budgeting to Different Lifestyles:

- Personalization: Recognize that generic budgets may not suit everyone. Personalize your budget to align with your lifestyle, preferences, and financial goals. A budget crafted to your needs is more likely to be sustainable.

- Regular Review: Life is dynamic, and so should be your budget. Regularly review and adjust your budget to accommodate changes such as job transitions, income fluctuations, or new expenses.

Addressing common budgeting challenges requires proactive strategies and a willingness to adapt. By understanding potential roadblocks and implementing practical solutions, you can confidently navigate your financial journey.

Cultivating Financial Discipline:

Discipline is the driving force behind effective budgeting. It involves sticking to your financial plan, making intentional choices, and resisting impulsive spending. Understanding the importance of financial discipline is the first step toward achieving your monetary goals.

Tips for Overcoming Temptations:

- Create a Realistic Budget: Craft a budget that aligns with your lifestyle and allows for occasional indulgences. A realistic budget is more likely to be sustainable, reducing the temptation to overspend.

- Prioritize Financial Goals: Clearly define your financial goals and prioritize them. Whether it’s debt repayment, saving for a vacation, or building an emergency fund, having clear goals helps in maintaining focus.

You Need a Budget to Support Financial Discipline:

- Utilize Budgeting Tools: Platforms provide tools that facilitate disciplined financial management. These tools help track spending, set budget goals, and provide insights into your financial habits.

- Regularly Monitor and Adjust: Regularly monitor your budget and make adjustments as needed. Life circumstances change, and your budget should adapt accordingly. Consistent review ensures that you stay on track.

Staying on Track:

- Accountability with apps: It’s an easy way to keep everything centralized and easy to track your progress.

- Spreadsheets – Some use apps but a simple Google spreadsheet also works as a starting point. I’ve used this free tracker and our team is constantly updating.

Through the exploration of key topics such as the benefits of having a budget, building a solid financial foundation, practical budgeting tips, addressing common challenges, and cultivating financial discipline, we’ve unraveled the transformative power of intentional financial management.

Budgeting is not merely a financial tool; it’s a lifestyle that leads to stability, peace of mind, and the fulfillment of your financial goals. The benefits of having a budget extend beyond the numbers on a spreadsheet; they resonate in the tangible improvements to your overall quality of life.

As you embark on your budgeting journey, remember that flexibility and adaptability are allies. Life changes, goals evolve, and challenges arise. A successful budget isn’t static; it’s a dynamic roadmap that adjusts to your unique circumstances.

Take the first step today! Craft your budget, set your goals, and cultivate the financial discipline that will propel you toward the life you envision. The journey may have challenges, but armed with the knowledge and tools shared here, you’re equipped for success.

Pingback: Saving Money : Your Roadmap to Financial Success - Easy Budget Tips